Depreciation Book Value Formula

The result is the depreciable basis or the amount that can be depreciated. The assumption in this depreciation method is that the annual cost of depreciation is the fixed percentage 1 - K of the Book Value BV at the beginning of the year.

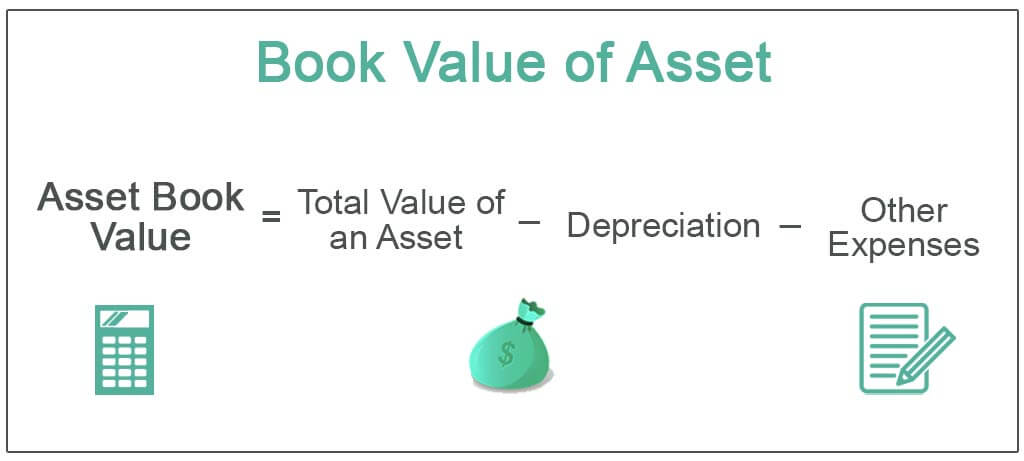

Book Value Of Assets Definition Formula Calculation With Examples

Divide the sum of step 2 by the number arrived at in step 3 to get.

. Determine the useful life of the asset. On April 1 2012 company X purchased a. In our example the NBV of the logging companys truck after four years would be 140000.

Under this method we charge a fixed percentage of depreciation on the reducing balance of the asset. The following is the amount written off over three years assuming a rate of depreciation of 15 using this method. Book Value 800 - 400.

To calculate depreciation using the straight-line method subtract the assets salvage value what you expect it to be worth at the end of its useful life from its cost. Accumulated depreciation is the total depreciation of the fixed asset accumulated up to a specified time. Therefore the calculation of book value per share is as follows BVPS Total Common shareholders equity Preferred Stock Number of outstanding common shares.

Depreciation 2 Straight line depreciation percent book value at the beginning of the accounting period. Declining Balance Method is sometimes called the Constant-Percentage Method or the Matheson formula. In this context market value is the value of that asset in a marketplace.

When referring to a company book value is the total value of a company if all of its assets were liquidated and all of its liabilities were paid off. A company acquires an asset for INR 25 lakhs with a salvage value of INR 5 lakhs and an estimated life of 15 years. Web Book value of an asset is the value at which the asset is carried on a balance sheet and calculated by taking the cost of an asset minus the accumulated depreciation.

Importance of Net Book Value. Therefore the book value is 85. Depreciation by Declining Balance Method.

First we need to find out shareholders equity which is the difference between Total Assets and Liabilities which is 5350085089 3568977062 1781108027. Web Accumulated Depreciation 15000 x 4 years 60000. Book value is also the net.

Web Reducing balance depreciation Book value at the start of the year x depreciation rate100. 2 02 30000 12000 In the first year of service the company deducts 12000 from the value of the lorry and it appears as a depreciation expense on its yearly income statement. P B x N t S.

Book value Cost of the asset accumulated depreciation. P Present amount or worth. Web When referring to an asset book value is the value of an asset on a balance sheet minus the cost of depreciation.

Web Diminishing balance or Written down value or Reducing balance Method. Web B 85. Therefore the book value would be currently equal to.

Web Considering the example of a computer that was purchased for 800 five years ago the formula can be written as. Web The fourth step is to enter the straight-line depreciation rate in the double-declining depreciation formula and the book value for this year. Double declining balance is the most widely used declining balance depreciation method which has a depreciation rate that is twice the value of straight line depreciation for the first year.

The amount of depreciation reduces every year under this method. Web How to Calculate Straight Line Depreciation. Web Depreciation per year Book value Depreciation rate.

Web The formula is. Net book value is among the most common financial metrics around. Calculating the Present Amount or Worth when the Book Value the Salvage Value the Total Estimated Life of the Asset and the Number of years of the Asset is Given.

Use a depreciation factor of two when doing calculations for double declining balance. TextDepreciation textBook Value times fractextRate of Depreciation100. The straight line calculation steps are.

Web For book purposes most businesses depreciate assets using the straight-line method. Determine the cost of the asset. Net Book Value 200000 60000 140000.

Subtract the estimated salvage value of the asset from the cost of the asset to get the total depreciable amount. B Book value over a period of time.

How To Calculate Book Value 13 Steps With Pictures Wikihow

How To Calculate Book Value 13 Steps With Pictures Wikihow

Comments

Post a Comment